When it comes to running an indoor playground, ensuring the safety and security of both children and your business is paramount. One crucial aspect of this is securing comprehensive indoor playground insurance. This type of insurance provides protection against a variety of liabilities, but understanding the cost involved can be complex and varies based on multiple factors. Let’s dive into what influences the cost of indoor playground insurance and what you can expect when shopping for a policy.

Factors Affecting Indoor Playground Insurance Cost

Several key factors can influence the premiums you’ll pay for indoor playground insurance:

1. Location and Size of the Playground

The geographical location and size of your indoor playground significantly impact insurance costs. Playgrounds situated in urban areas with higher crime rates or those located in regions prone to natural disasters might face higher premiums. Additionally, larger facilities typically require more extensive coverage due to the increased number of visitors and activities offered, which can also escalate the cost.

2. Types of Equipment and Amenities

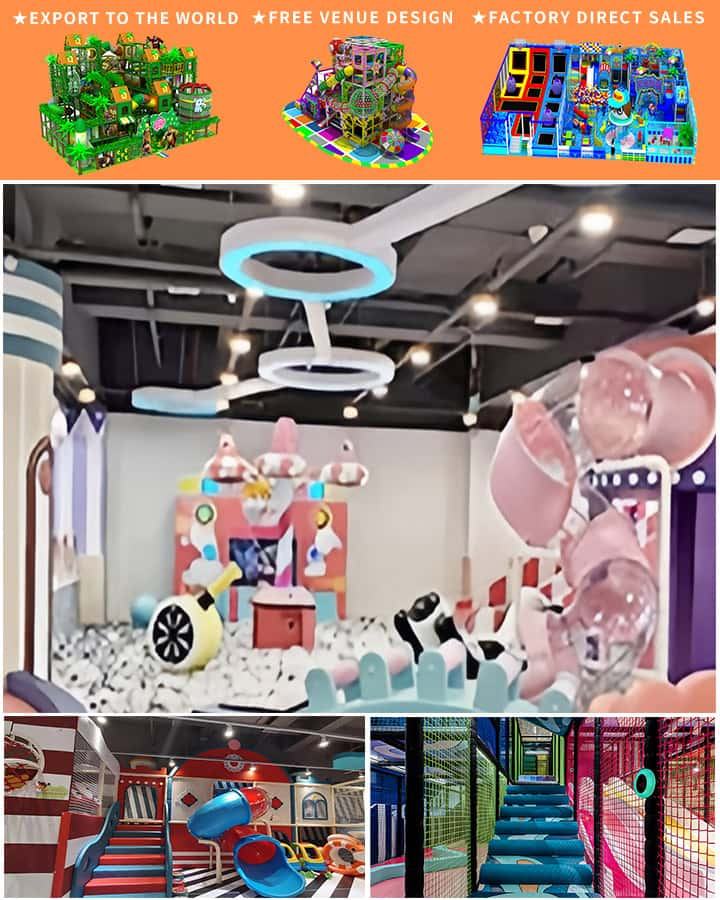

The variety and complexity of the equipment available at your playground are critical in determining your insurance costs. Trampolines, climbing structures, ball pits, and slides all come with different levels of risk. Modern, well-maintained equipment that meets safety standards can sometimes reduce insurance costs, while older or high-risk equipment may increase them.

3. Safety Protocols and Staff Training

Demonstrating robust safety protocols and well-trained staff can positively influence your insurance premiums. Insurers often offer discounts for businesses that invest in comprehensive training programs and maintain strong safety records. Having certifications and adhering to industry guidelines can make your business less risky in the eyes of insurers.

4. Coverage Limits and Deductibles

The extent of coverage you choose directly affects your insurance cost. Higher coverage limits and lower deductibles will result in higher premiums. Conversely, opting for lower coverage limits or higher deductibles can reduce your costs but may leave you underinsured in case of significant claims.

Average Cost of Indoor Playground Insurance

While it’s challenging to provide an exact figure without specific details about your business, general estimates suggest that indoor playground insurance can range from a few hundred to several thousand dollars annually. Smaller operations with minimal equipment and fewer visitors might find themselves on the lower end of the spectrum, whereas large, multifaceted facilities could see higher premiums.

Tips to Manage Insurance Costs

1. Shop Around

Don’t settle for the first insurance quote you receive. Comparing rates from different providers can help you find more competitive pricing without compromising on coverage quality.

2. Bundle Policies

If you own other types of insurance (e.g., property, liability), bundling them with your indoor playground insurance can sometimes lead to discounts.

3. Risk Management

Implementing effective risk management strategies, such as regular equipment maintenance, thorough staff training, and stringent safety checks, can help mitigate risks and potentially lower your insurance costs over time.

4. Review Annually

Insurance needs can change, especially as your business grows or evolves. Reviewing your policy annually ensures that you have adequate coverage and can adjust based on any new developments.

Conclusion

Investing in indoor playground insurance is not just about meeting legal requirements; it’s about safeguarding your business against unforeseen events and ensuring peace of mind. While the cost can vary widely depending on various factors, taking proactive steps in managing risks and choosing the right coverage can help keep your premiums affordable. Always remember to shop around, bundle policies where possible, and prioritize safety to protect both your business and your customers effectively.